The COVID-19 pandemic and ensuing lockdowns for the past two years have not only caused a sudden shift in consumer behaviour to online transactions, but it has also resulted in a massive boom to the e-shopping industry. This accelerated shift is likely to be permanent as experts and businesses alike start discussing how people are embracing the new normal and what that will look like moving forward.

It is worth noting that the new normal is not about living with perpetual lockdowns. Instead, it is about adopting measures to minimise and mitigate the impact of COVID-19 within our community. This can be done while reopening most, if not all our social and economic activities in a safe and controlled post-vaccination environment.

This begs the question; how will business models change? What will happen to employees? As we have witnessed, hundreds of startups and fintech businesses are thriving during the pandemic, indicating the need and popularity of tech-based innovation during this period.

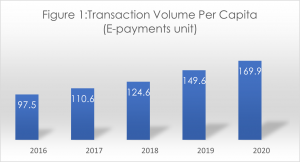

Using cloud-computing platforms and software, fintechs and startups are deploying analytics and artificial intelligence (AI) solutions to grab market share in the financial service markets, banking, retail and former traditional markets. Digital payment solutions have become a necessity during the pandemic. For example, e-payment transaction volume per capita in Malaysia reached 169.9 in 2020 representing a 13.5% increase from the previous year (Figure 1). Such business trend is expected to continue in a post-pandemic environment.

Source: Bank Negara Malaysia

Despite this, it is worth noting that Department of Statistics Malaysia (DOSM) data shows that the stringent measures taken to contain the spread of COVID-19 have reduced working hours, causing the mean monthly salary received by Malaysians to fall 9% in 2020. Consequently, the nation’s unemployment rate went up to 4.5% due to the closure of many SMEs that have previously provided employment to Malaysians.

It will take some time for employment and salaries to recover, due to the slower school-to-work transition for young people and graduates in the immediate years following the pandemic. Therefore, the government has to invest in providing more reskilling and upskilling opportunities, particularly in the digital sector, for Malaysians in the coming years.

DOSM also recommended that due to the prolonged restrictions at the national borders that have affected the nation’s overall economic growth and revenue, key industries like tourism must embrace digitalisation, and focus on developing smart products and infrastructure. This will help them recover while also strengthening their resilience for any future pandemic or economic downturn. According to recommendations by the Malaysian Investment Development Authority (MIDA), ‘Smart Tourism’ may be the way forward to take advantage of the opportunities within the digital age that were highlighted by DOSM.

On its own, measures rolled out by the government such as wage subsidies, RM10 billion fiscal injection and RM150 billion National People’s Well-being and Economic Recovery Package (PEMULIH) may be insufficient to reverse the effects of unemployment experienced in 2021. Today, we are still experiencing an environment where businesses are closing or scaling down their operations, leading to more unemployment or instances where employees may accept lower pay just to get or keep a job.

The introduction of the PEMULIH financial package of RM300 may serve as a starting financial support for fresh graduates and those working in the informal sector. However, this must also be accompanied by an integrated labour market policies that could enhance upskilling and reskilling activities in connection to digitalisation. Beyond that, it will promote entrepreneurial opportunities and the proliferation of home-based businesses.

Technological competition, innovation, AI, and R&D activities will further accelerate industry growth and recovery, given the shift towards online businesses and government services. The future of work will be different. Finance and economics structures will become more complicated. At the same time, they will be transformed by cryptocurrencies and blockchain technology. Social media and technological platforms intrude into the lives of all as we evolve into the age of big data governance and technological environment.

The future will certainly post many challenges as we approach the digitalisation era where there is still insufficient local talents. This problem will be magnified as the gig sector becomes an even bigger part of our economy. Therefore, we need to provide more training and development opportunities for our talent pool. Additionally, the post-pandemic employment will require further planning where the efficacy and efficiency at the core of the digital economy will connect a multitude of players across agencies and marketplaces.

Furthermore, it is also essential to note the new boundaries between work and personal activities that have been enabled by flexible work arrangements in the digital era. Remote working and hybrid working models will continue to be the norm post-pandemic. Most organisations, particularly those in the private sector, may want to have a more detailed vision of this hybrid engagement model and how it aligns to productivity targets and globalisation goals.

Nonetheless, there ought to be clarity on how an employee can claim for social protection and to work out key details that may include flexible work schedules.

Technological innovation has enabled many continuous changes in institutions. These have included cutting costs and improving knowledge in institutional cooperation and competition. Malaysia has benefited greatly from its usage of foreign labour in the short and medium term. However, there may be long-term political and economic costs to our heavy reliance on foreign labour. Such realisations have led many high income developed nations such as Singapore, South Korea and Japan to devote substantial resources on creating policies that support the training and development of local talents, allowing these countries to move away from being completely dependent on foreign labour.

Failure to implement adequate recovery measures as quickly as possible could result in the nation’s delayed recovery and with that the stagnation of skills development amongst local talents. Therefore, talents, organisations and industries alike need to embrace a digital-led change quickly and holistically. In fact, according to MDEC and the Malaysian Digital Economic Blueprint, it is estimated that by 2025, the digital economy will contribute 22.6% to the country’s GDP. Digitalisation needs to be carefully planned in such a way that it can be optimised for skills development. This will include the utilisation of a combination of AI and human expertise to match talent demand with supply, while also placing the right products and solutions across industries.

The migration towards digitalisation is inevitable as businesses further depend on digital solutions to offer greater speed, and convenience across the rapidly changing business landscape. Recent digital solutions and investments in technology have enabled local businesses, especially the retail sector to continue operating as usual. Even home-based businesses could conduct their businesses without major disruption, thanks to social media like Facebook and Instagram and digital services like Touch n Go e-wallet, Boost, Lalamove and more.

No doubt, we are witnessing a revolution like no other as digital solutions bridge the gap between business offerings and consumer expectations, all while minimising external disruptions. Payment gateways such as Alibaba, Amazon, eBay, Flipkart, Rakuten, DuitNow RQ, PayNow QR, credit cards, and FPX have made online transactions and business processes more seamless. To remain competitive, many businesses have no choice but to migrate to online payment platforms and grow their digital footprint. In the post-pandemic economy, market landscapes will undergo even more changes, leveraging the rapid development and innovation in digital solutions.

This will also impact the talent development pipeline and result in an even bigger change in consumer behaviour. To thrive in this digital-first post-pandemic economy, businesses need to embrace all of this, while also keeping in mind the threat of malware, hackers and other cybersecurity challenges. By striking this delicate balancing act between innovation and security, we can rest assured that Malaysian businesses, organisations, talents and government can succeed together in our collective effort towards digitalisation.

Professor Dr. Loo-See Beh is with the Faculty of Business and Economics, University of Malaya. She is also a Research Fellow of the National Human Resource Centre (NHRC) of HRD Corp.

The views expressed here are entirely the writer’s own.